In the world of finance, trading currencies has become increasingly accessible thanks to the rise of online forex trading platforms Trading Platform BD. These platforms provide traders of all levels with the tools they need to engage in forex trading from the comfort of their homes or on the go. This article aims to provide a thorough understanding of online forex trading platforms, including what they are, their features, and how to select the right one for your trading strategy.

What is Forex Trading?

Forex trading, or foreign exchange trading, involves the buying and selling of currencies in pairs, such as EUR/USD or GBP/JPY. Traders speculate on the changes in exchange rates to make a profit. With a daily trading volume exceeding $6 trillion, forex is one of the largest financial markets in the world. Online trading platforms have democratized access to this market, allowing individual investors to trade alongside institutional players.

The Role of Online Forex Trading Platforms

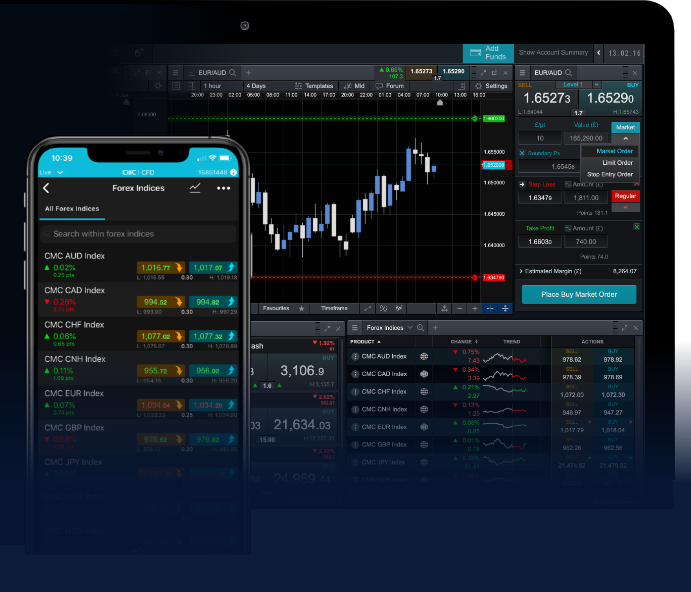

Online forex trading platforms serve as intermediaries between forex traders and the market. They provide the necessary tools and features to facilitate currency trading efficiently. These platforms come with a user-friendly interface that allows traders to execute trades, analyze market data, and manage their accounts. Typically, these platforms offer features such as real-time price feeds, charting tools, news, and educational resources.

Key Features of Online Forex Trading Platforms

When choosing a forex trading platform, consider the following key features:

- User Interface: A clean and intuitive interface is essential for both beginners and experienced traders. A user-friendly design enhances the trading experience and makes it easier to execute trades quickly.

- Charting Tools: Robust charting capabilities allow traders to analyze price movements over various time frames. Good platforms also include technical indicators and customizable charts.

- Order Types: Various order types, including market, limit, and stop-loss orders, provide traders with flexibility and control over their trades.

- Leverage: Forex trading often involves leverage, which allows traders to control larger positions with a smaller amount of capital. Understanding leverage and its risks is crucial.

- Regulation and Security: Ensure the platform is regulated by a recognized financial authority and offers secure transaction methods to protect your funds.

- Customer Support: Responsive customer support can significantly enhance the trading experience, particularly for beginners who may have questions or need assistance.

- Mobile Trading: The ability to trade on-the-go through mobile applications or responsive web platforms is increasingly important for today’s traders.

Types of Forex Trading Platforms

There are several types of forex trading platforms available to traders, each with its benefits:

- MetaTrader 4 (MT4): One of the most popular trading platforms globally, MT4 is known for its robust charting tools, automated trading capabilities through Expert Advisors (EAs), and a wide range of plugins and indicators.

- MetaTrader 5 (MT5): The successor of MT4, MT5 offers advanced features such as more time frames, improved charting tools, and access to a wider range of assets beyond forex, including commodities and stocks.

- cTrader: This platform is known for its intuitive interface and excellent charting capabilities. It is popular among algorithmic traders due to its API and automated trading features.

- Proprietary Platforms: Some brokers offer proprietary platforms designed specifically to meet their clients’ needs. While these platforms are not as well-known as MT4 or cTrader, they can offer unique features and enhanced user experiences.

How to Choose the Right Forex Trading Platform

Choosing the right forex trading platform is crucial for your trading success. Here are some steps to help you make an informed decision:

- Identify Your Trading Style: Determine whether you are a day trader, swing trader, or long-term investor. Your trading style will influence the features you need in a platform.

- Research Brokers: Look for brokers with good reputations, favorable reviews, and transparent fee structures. Check if they offer the trading pairs you are interested in.

- Test the Platform: Many brokers provide demo accounts. Utilize these to test the platform’s features and usability without risking real money.

- Check Regulation: Ensure the broker and platform are regulated by a recognized authority to protect your funds and maintain a secure trading environment.

- Analyze Fees and Commissions: Compare different platforms’ trading costs, including spreads, commissions, and withdrawal fees, to find the most cost-effective option.

The Future of Online Forex Trading Platforms

The landscape of online forex trading platforms is continually evolving, driven by technological advancements and changing trader needs. The integration of artificial intelligence, machine learning, and blockchain technology presents exciting possibilities for the future of trading. Platforms that prioritize user experience, connectivity, and innovative tools will likely lead the way.

Conclusion

Online forex trading platforms have made it possible for anyone to participate in the global currency market. By understanding the features, types, and how to choose the right platform, traders can equip themselves with the tools needed for successful trading. As the industry evolves, staying informed about new developments and adapting to changes will be key to thriving in this dynamic environment.