Understanding the Fees Charged by Pocket Option

When it comes to trading in the financial markets, understanding the various fees that apply is crucial for optimizing your strategy and managing your investments effectively. In this comprehensive guide, we will delve into the intricacies of Fees Pocket Option fees Pocket Option, including deposit and withdrawal charges, trading fees, and other potential costs that every trader should be aware of.

What is Pocket Option?

Pocket Option is a popular online trading platform that specializes in binary options and provides users with a seamless trading experience. Established in 2017, it has gained recognition for its user-friendly interface, responsive customer service, and a wide range of trading assets, including currencies, commodities, stocks, and cryptocurrencies. However, it is essential for traders to navigate its fee structure to ensure their trading remains profitable.

Types of Fees Associated with Pocket Option

Understanding the types of fees associated with Pocket Option is vital for any trader looking to utilize this platform effectively. Here are the primary types of fees to be aware of:

1. Deposit Fees

When you add funds to your Pocket Option trading account, you may encounter deposit fees depending on the payment method used. While many methods, such as bank transfers or e-wallets, are free, some may charge a fee. It’s essential to check the specific terms for the method you select before making a deposit to avoid unexpected costs.

2. Withdrawal Fees

Withdrawal fees can significantly impact your overall trading profitability. Pocket Option has a structured withdrawal system that may charge fees based on the payout method. For example, withdrawals via certain e-wallets may incur lower fees compared to bank wire transfers. It’s advisable to review the withdrawal policy and fees associated with your preferred payout method to make informed decisions.

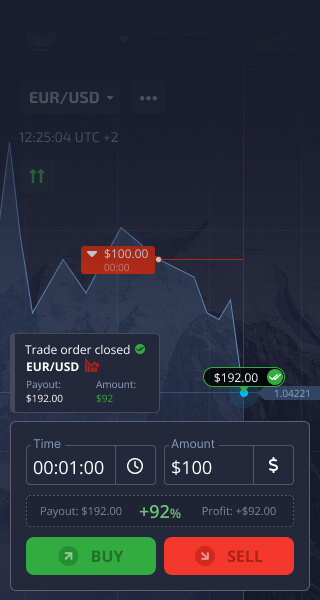

3. Trading Fees

Unlike traditional stock trading platforms, Pocket Option operates on a different commission model. Traders are not charged standard commission fees per transaction but should be aware of the implicit costs associated with spreads and other trading conditions. The difference between the buying and selling price is referred to as the spread, and this can vary based on market conditions.

4. Inactivity Fees

Another aspect to consider is inactivity fees. If your account is dormant for an extended period, Pocket Option may impose a fee. This policy encourages traders to remain active and engaged with their accounts and trading strategies. Familiarizing yourself with the inactivity fee structure is crucial, as it may catch users off-guard who do not regularly trade.

How Fees Affect Your Trading Strategy

Understanding how fees can impact your trading strategy is vital for minimizing costs and maximizing profits. Here’s how different fees can influence your trading decisions:

1. Impact on Profits

Every trade you execute has an associated cost. High withdrawal fees or trading spreads can eat into your profits, making it essential to calculate the potential fees involved in executing different trade strategies. If you plan to make numerous trades, lower fees could significantly increase your overall profitability.

2. Choosing Payment Methods Wisely

Your choice of payment methods can influence the fees you incur. For instance, while credit transfers may have higher withdrawal fees, using e-wallets could provide a more cost-effective solution. Always weigh the costs and benefits of each payment method before deciding how to fund your account or make withdrawals.

3. Staying Active to Avoid Inactivity Fees

To avoid inactivity fees, it is important to regularly engage with the platform. This can involve executing trades, analyzing market trends, or researching new strategies. By keeping your account active, you not only evade additional costs but also enhance your trading skills.

Conclusion

Understanding the fees Pocket Option imposes is crucial for every trader aiming to optimize their trading experience. From deposit and withdrawal charges to trading fees and inactivity costs, navigating these elements effectively can significantly impact your overall trading success. By staying informed and actively managing your account, you can mitigate potential charges and focus on what really matters: successful trading.

For further information on fees and how they may affect your trading, always consult the official Pocket Option website or reliable financial advisors.