Forex trading is a vital component of global financial markets, offering opportunities for profit through currency exchange. However, when it comes to Islamic Forex trading, specific guidelines must be followed to ensure compliance with Sharia law. In this article, we will delve into the fundamentals of Islamic Forex trading, highlight its principles, and discuss the ethical considerations involved. You can find more information on this topic at islamic forex trading https://tradingarea-ng.com/.

Introduction to Islamic Forex Trading

Islamic Forex trading refers to the practice of currency trading that adheres to the principles of Islamic finance, which prohibits activities such as Riba (usury or interest) and Gharar (excessive uncertainty). Forex, by nature, is a fast-paced market where currencies are traded in pairs. The Islamic perspective on this trading practice significantly influences how Muslims engage in Forex transactions.

Key Principles of Islamic Finance

To understand Islamic Forex trading, it is crucial to grasp the foundational principles of Islamic finance. These include:

- Prohibition of Riba: Interest is strictly forbidden in Islam. This means that any trading that involves paying or receiving interest is not permissible.

- Prohibition of Gharar: Transactions that involve excessive uncertainty or risk are avoided. Muslims are advised to engage in transparent and clear transactions.

- Ethical Investments: Investments should be made in socially acceptable activities and industries. Investments in businesses related to alcohol, gambling, or pork are prohibited.

- Risk Sharing: Islamic finance promotes sharing the risks and rewards between parties involved in a transaction.

Understanding Forex Trading Mechanics

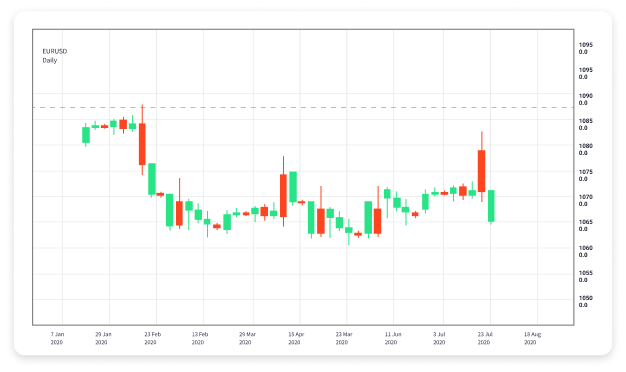

Forex trading involves buying one currency while selling another, with the aim of capitalizing on fluctuations in currency values. The Forex market operates 24 hours a day, with different regions of the world trading at different times. Here are some basic concepts relevant to Forex trading:

- Currency Pairs: Currencies are traded in pairs (e.g., EUR/USD, GBP/JPY). The first currency is the base currency, while the second is the quote currency.

- Leverage: Traders can control large positions with a relatively small amount of capital, amplifying potential profits or losses.

- Spread: The difference between the buying and selling price of a currency pair. A tighter spread generally indicates better trading conditions.

Islamic Forex Accounts

To participate in Forex trading within the framework of Islamic law, traders can choose to open an Islamic Forex account. These accounts are designed to be compliant with Sharia principles:

- No Overnight Fees: Islamic accounts do not incur swap fees or overnight interest, which is essential for compliance with Riba prohibitions.

- Transparent Trading Conditions: Many brokers provide clear guidelines on how their Islamic accounts operate to ensure transparency and minimize Gharar.

- Ethical Trading Practices: Traders are encouraged to engage only in trades that adhere to Islamic principles, avoiding any prohibited activities.

Choosing a Reliable Broker

Selecting a reliable Forex broker is essential for any trader, especially for those seeking Islamic Forex trading options. Here are some characteristics to look for:

- Regulation: Ensure that the broker is regulated by a recognized authority. This provides a level of trust and protection for your funds.

- Islamic Account Options: Verify that the broker offers Islamic trading accounts that comply with Sharia law.

- Trading Platform: A user-friendly platform with a range of analytical tools can enhance your trading experience.

- Customer Support: Reliable customer service is essential for resolving any inquiries or issues that arise while trading.

Risk Management in Islamic Forex Trading

Since risk management is critical in Forex trading, it is even more vital for Islamic traders who want to avoid excessive uncertainty. Here are some effective strategies:

- Setting Stop-Loss Orders: A stop-loss order helps protect your investment by automatically closing a position at a predetermined loss level.

- Diversifying Your Portfolio: Avoid putting all your funds into one trade or currency pair to lower risk exposure.

- Using Position Sizing: Determine the size of your trades based on your risk tolerance and account size to prevent significant losses.

Conclusion

Islamic Forex trading offers Muslims a legitimate way to participate in the Forex market while adhering to the tenets of Islamic finance. By understanding the principles of Sharia law and employing ethical trading practices, traders can navigate the complexities of the Forex market effectively. With the right broker and a solid understanding of risk management, Muslim traders can engage in Forex trading confidently and responsibly. Always ensure that your trading practices align with your beliefs while striving for financial growth in the global market.